Argentina is facing its worse inflationary crisis since 1991 following a monthly inflation report of 7.7%, far exceeding the expected rate of 7.1%. Argentinians are facing rising costs, declining savings and economic turmoil, placing additional strain on the country’s government. According to sources, record inflation is a result of elevated international pricing and a severe drought with billions lost due to crop failure. Argentina is one of the world’s largest grain exporters; lost exports related to the drought have deepened the economic crisis. Elevated prices and reduced income due to the drought have created an untenable situation as poverty reaches 40%.

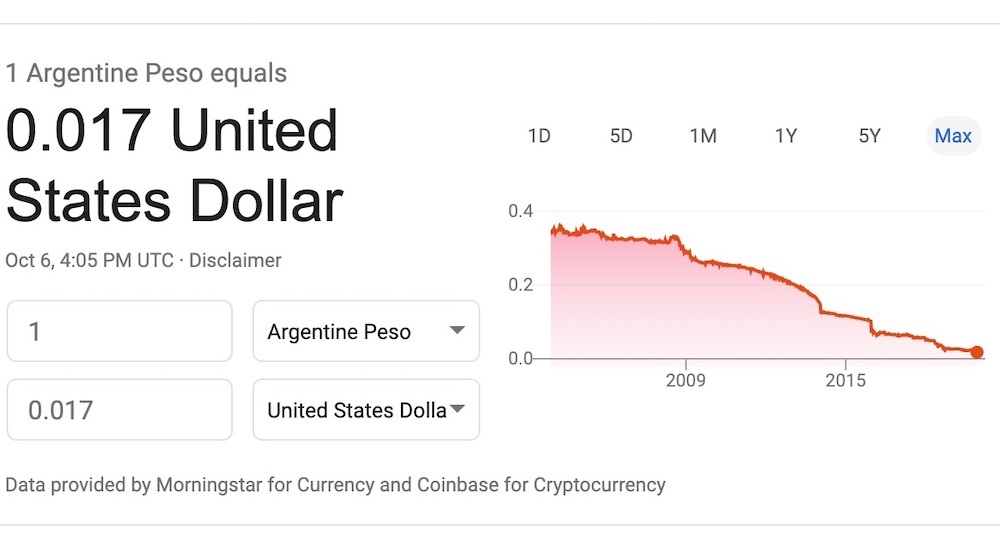

Argentina’s inflation problem goes beyond international inflation and unfavorable climate conditions however. The country’s economy has struggled in the past, specifically back in 2019 with a massive sale of government bonds. The government subsequently defaulted on those bonds, resulting in a loss of credit. Then came the pandemic. The Argentinian government responded by printing more of their currency to support the economy, which resulted in more inflation. A currency crisis followed, with significant devaluing of Argentina’s peso (as shown in the chart below). Record inflation, poverty and a devalued currency have left many of its citizens in a state of despair. According to a recent article by El Pais, elderly retirees are now faced with choosing between food or medicine. From the article “Food or medicine? Inflation squeezing retirees in Argentina” —

The impact has been particularly devastating on Argentina’s retirees, 85% of whom receive a state pension averaging 58,500 pesos a month, the equivalent of $265. That barely covers a third of their expenses for food, medicine and rent.

“I can’t even pay the rent, my daily expenses, services, and I have to eat. I have two children who bring me a ‘little package’ (of money),” Paulina Najnudel, 85, said as she played bingo. “But it makes me, not ashamed, but sad because we have worked so many years.”

Argentina had one of the most advanced pension systems in South America, with retirement pensions increasing according to a mobility formula calculated by wages and taxes collected. Between January 2022 and March 2023, pensions rose 72.5%. But in the same period prices rose more than 100%.

Now, after years of high inflation, Argentina’s minimum pension measured in U.S. dollars is one of the lowest in the region, just above Venezuela, according to a study by the Argentine consulting firm Focus Market.

“The minimum pension is not even enough for the basics,” said Ana Falcone at the retirement center.

Mercedes Villafañe, 80, described the crisis during a game. “When we retirees go shopping, we don’t by food by the kilo. We buy it by the item: one onion, one potato. We never have enough to make it to a kilogram.”

“At the moment, there is no hope,” she said.

Argentina’s inflation crisis should serve as a cautionary tale. Government policies have consequences, out of control spending cannot persist indefinitely. Eventually, the basic rules of economics will catch up with the reality of failed policies. As the US dollar remains the world’s reserve currency, the value of Argentina’s peso plummets – but the price of gold surges. The ultimate conclusion remains to be seen; the current outlook does not look very optimistic for Argentina.